A strong partnership starts with a strong foundation. When Cint, a global leader in digital...

Understanding the Gabor-Granger Pricing Method

The Gabor-Granger method is a pricing research technique used to assess the price elasticity of products and services. This method offers market research insights into how changes in price impact consumer demand, helping businesses make informed pricing decisions.

The Gabor-Granger approach revolves around simplicity, directly questioning potential customers about their likelihood of purchasing a product or service at different price points. Leveraging the Gabor-Granger method helps businesses simulate real-world buying behavior, compare pricing strategies, collect data rapidly, and manage research costs effectively.

What Is the Gabor-Granger Pricing Method?

The Gabor-Granger pricing method was developed in the 1960s by two economists, Andre Gabor and Clive Granger. The pricing method's purpose is to assist in determining the price elasticity of products and services and the sensitivity of consumer demand to changes in price.

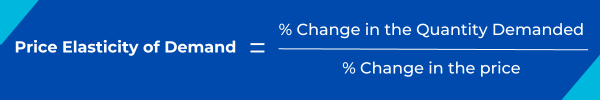

Price elasticity is how responsive the quantity demanded of a product or service is to changes in its price. A higher absolute value of the price elasticity indicates greater sensitivity to price changes. Price elasticity is a crucial concept in economics as it helps businesses understand how their pricing decisions may impact the demand for their products or services. Quantifying the price elasticity of a product or service can help a company make informed decisions regarding market strategies and revenue optimization.

The formula for price elasticity of demand is as follows:

The Gabor-Granger method offers a straightforward approach to estimating price elasticity. It involves surveying individuals and asking them about their likelihood of purchasing a particular product or service at different price points. Varying the price levels and recording the respondents' corresponding likelihood allows researchers to analyze the relationship between price and demand.

The simplicity of the Gabor-Granger method is one of its key strengths. The technique helps companies research consumer preferences and buying behavior without using complex mathematical models or conducting extensive market research. However, it is important to note that the method assumes respondents accurately represent the broader consumer population and provide reliable responses.

How Does the Gabor-Granger Technique Work?

The Gabor-Granger technique operates through a series of steps to determine the optimal price for maximizing revenue. These steps involve surveying potential customers and analyzing their responses to various price points.

First, the method employs a survey that asks respondents about their likelihood of purchasing a specific product or service at a given price level. Based on their response, they are subsequently presented with different prices and are requested to indicate their willingness to buy at each price point shown.

A sufficient number of respondents must participate in the survey to ensure statistical significance. The sample size must be large enough (100 or more respondents) to provide reliable insights into consumer preferences and behaviors.

Researchers can then plot the collected data on a revenue and demand curve, helping to visualize the relationship between price and demand. This graphical representation aids in identifying the price point that generates the maximum revenue.

Providing a concise description or featuring an image of the product or service is essential when implementing the Gabor-Granger technique. This contextual information helps respondents make more informed decisions regarding their potential purchase.

The survey question typically follows the format:

Respondents indicate their likelihood of purchasing on a scale ranging from very likely to unlikely.

Based on the respondent's answers, if they indicate a lower likelihood of purchasing at a particular price point, they are then shown a lower price to assess their willingness to buy. Conversely, if they express that they are more likely to purchase at a specific price, a higher price is presented to test their price sensitivity. This iterative process continues until the pricing model identifies the optimal price point that maximizes revenue.

Gabor-Granger Pricing Method Benefits

The Gabor-Granger pricing method offers several key benefits that make it valuable for pricing research. Let's explore them in more detail below:

Simplicity

The Gabor-Granger method is renowned for its simplicity, making it accessible to researchers with varying experience and expertise. Compared to more complex pricing research techniques like conjoint analysis and Van Westendorp, the Gabor-Granger method does not require specialized tools or extensive training.

It involves presenting respondents with a series of predetermined price points and asking them to indicate their likelihood of purchasing at each price. The straightforward instructions and use of simple rating scales and matrix questions, such as the Likert scale, make it easy for respondents to express their preferences. The ease of using the Gabor-Granger technique minimizes the potential for confusion or misinterpretation and streamlines the data collection process.

Simulates Actual Buying Behavior

The technique captures consumer purchase intentions using a realistic buying scenario that provides insights that align with real-world decision-making processes. Businesses can use the Gabor-Granger model to validate their pricing strategies in the competitive landscape.

Companies can anticipate consumer behavior, adjust pricing strategies, and make informed pricing decisions by assessing how price changes affect consumer preferences and purchase intentions. This approach is beneficial when businesses want to compete with competitive pricing or consider a penetration pricing model to gain market share.

Comparative Analysis

The Gabor-Granger technique allows businesses to conduct a comparative analysis of pricing strategies. Assessing how price changes affect consumer preferences and purchase intentions helps companies compare their product's price elasticity against competitor pricing.

This comparative analysis enables businesses to identify competitive advantages or disadvantages regarding price sensitivity. Furthermore, the Gabor-Granger pricing method helps researchers understand the impact of pricing on their competitive positioning. Organizations can gauge the likelihood of customers choosing their products over their competitors' offerings at various price levels and fine-tune their pricing strategies to improve their competitive position.

Rapid Data Collection

By directly asking respondents about their purchase intentions at different price levels, researchers can gather pricing data relatively quickly compared to methods that rely on observational data or extensive experiments. Analyzing the collected data is typically straightforward and does not involve complex statistical techniques.

The simplicity of the analysis process allows researchers to process and interpret the data swiftly, leading to quick insights and actionable findings. This rapid data collection helps businesses to make timely pricing decisions and respond quickly to market dynamics.

Low Research Costs

The Gabor-Granger method offers cost advantages, making it suitable for businesses with limited research budgets. It does not require expensive equipment or extensive data collection procedures. Typically, the method involves collecting responses from a sample of respondents through quantitative surveys.

With this technique, researchers can efficiently manage the data collection and use fewer resources, including time, personnel, and expenses, to realize cost savings.

Using the Gabor-Granger Technique for Survey Research

Gabor-Granger is an effective survey research technique to gather valuable pricing insights. These steps and example questions will help you implement the Gabor-Granger technique into your surveys.

Step 1: Determine the Price Range

First, decide on the price points or ranges you want to test in the survey. The survey can include various price levels or increments relevant to your product or service. For every price point, create a survey question asking respondents about their likelihood of buying at that price. Use a rating scale to capture their responses, such as "Extremely likely," "Very likely," "Somewhat likely," "Not very likely," or "Not at all likely."

Example survey question:

Step 2: Present Price Scenarios

Next, you will need to present respondents with different price scenarios. Be sure to vary the prices across the range you have determined and ask respondents to rate their likelihood of purchasing at each price point using the same rating scale as the previous step. Presenting various pricing scenarios will help you gather data on how purchase intentions change with different price levels.

Example follow-up question:

Step 3: Capture Additional Information

Along with capturing purchase intentions, consider asking questions that help you acquire additional information that may impact pricing decisions. This information can include demographics, preferences, or factors that respondents consider when purchasing.

Example survey question:

Step 4: Analyze and Interpret the Data

After collecting the survey responses, review the data to identify trends and patterns in purchase intentions at different price points. Calculate the percentage of respondents likely to purchase at each price level and evaluate the demand curve to understand price elasticity. This analysis will help provide insight into the price points that generate higher purchase likelihoods.

Step 5: Use Insights to Inform Pricing Decisions

Finally, you can use the insights gained from your Gabor-Granger survey research to inform your pricing strategy. Consider the price points that generate the highest purchase likelihood and align them with your business objectives, market dynamics, and competitive positioning. The data you collect through the Gabor-Granger technique will help inform future pricing decisions and strategies.

Gabor-Granger Techniques: Pros and Cons

While the Gabor-Granger technique offers simplicity, realistic insights, and cost-effectiveness, it also has limitations regarding scope, potential bias, and the exclusion of contextual factors. It's vital to weigh the following pros and cons when deciding whether to use this method for pricing research.

| PROS | CONS |

| Simplicity: Easy to implement and understand | Limited scope: Focuses primarily on price elasticity |

| Accessible: Does not require specialized tools or extensive training | Subject to bias: Relies on self-reported purchase intentions |

| Realistic insights: Simulates actual buying behavior | Limited demographic insights: May not capture diverse consumer segments |

| Comparative analysis: Allows for pricing strategy comparisons | May oversimplify complex pricing dynamics |

| Rapid data collection: Efficient and quick to gather pricing data | Lack of contextual factors: Does not consider external market conditions |

| Cost-effective: Requires fewer resources compared to other methods | Limited predictive power: Focuses on current purchase intentions |

Optimize Your Market Research with IntelliSurvey

The Gabor-Granger pricing method gives businesses a valuable tool for understanding price elasticity and making informed pricing decisions. Its simplicity, ability to simulate actual buying behavior, comparative analysis capabilities, rapid data collection, and cost-effectiveness make it a compelling option for pricing research.

If you're looking to gain valuable insights and make data-driven decisions, IntelliSurvey's survey data collection and analysis software supports a wide variety of projects, including more advanced pricing research and analysis. Our team is happy to help you collect data and obtain actionable insights - please contact us for more information.

Subscribe to our Monthly Newsletter

Related posts

We’ve heard from our clients that the testing portion of the survey programming process brings...

Surveys make it easier to perform tasks such as collecting feedback, performing employee...